Fundamentals of CLO Collateral and Structure

-

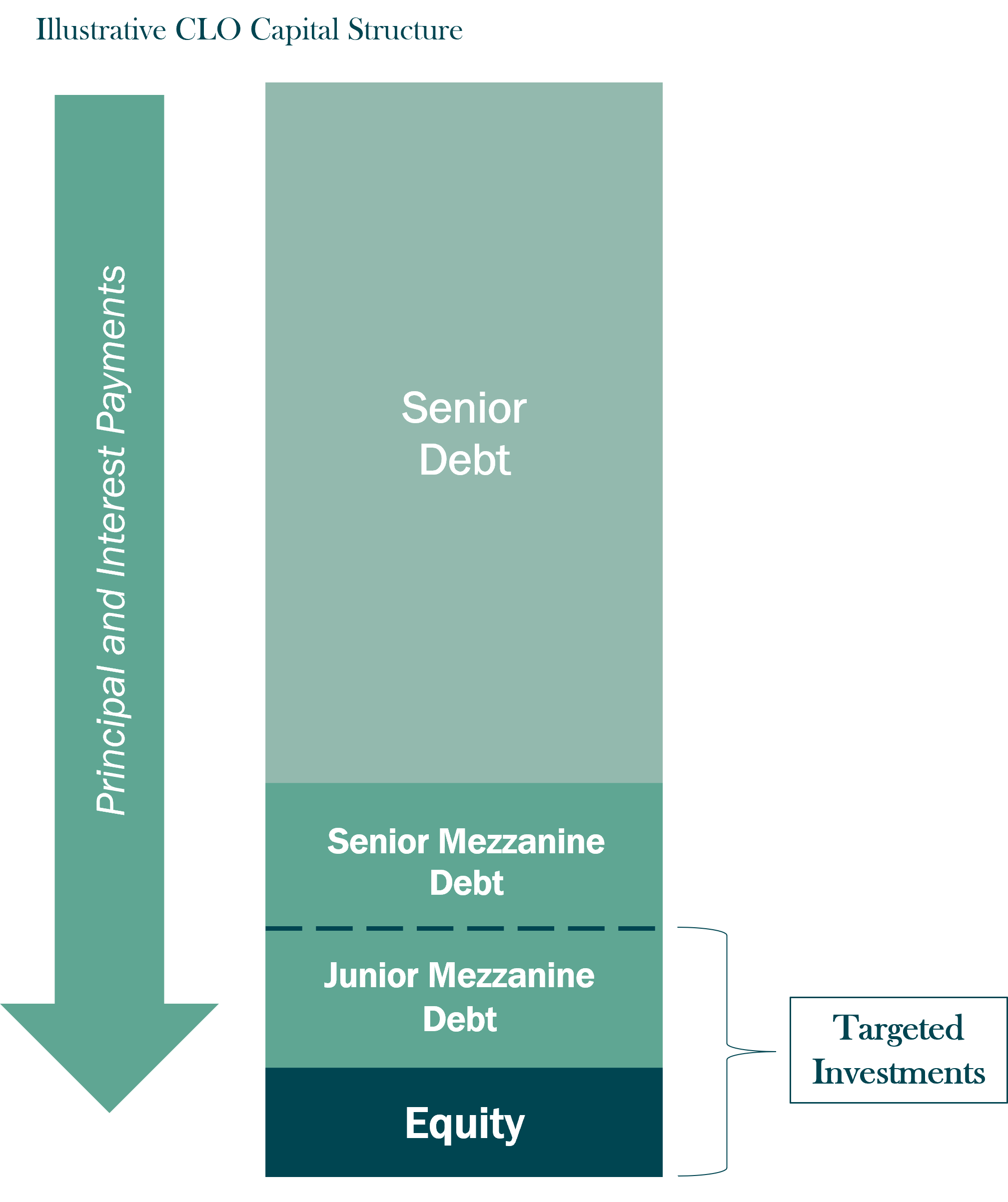

Collateralized loan obligations are securitizations typically backed by well-diversified pools of corporate loans.

- Underlying loans are typically senior secured, floating rate loans with an average issuance size of ~$1.5 billion

- The vast majority of loans carry public credit ratings from major rating agencies such as S&P, Moody’s, and Fitch

- Underlying borrowers are typically large, established businesses

-

CLOs receive principal and interest cash flows from their underlying assets and typically distribute them quarterly.

- Senior debt tranches are paid first, then mezzanine debt tranches, then equity

CLO Market Overview

Growing Asset Class with Improving Liquidity and Scalability

-

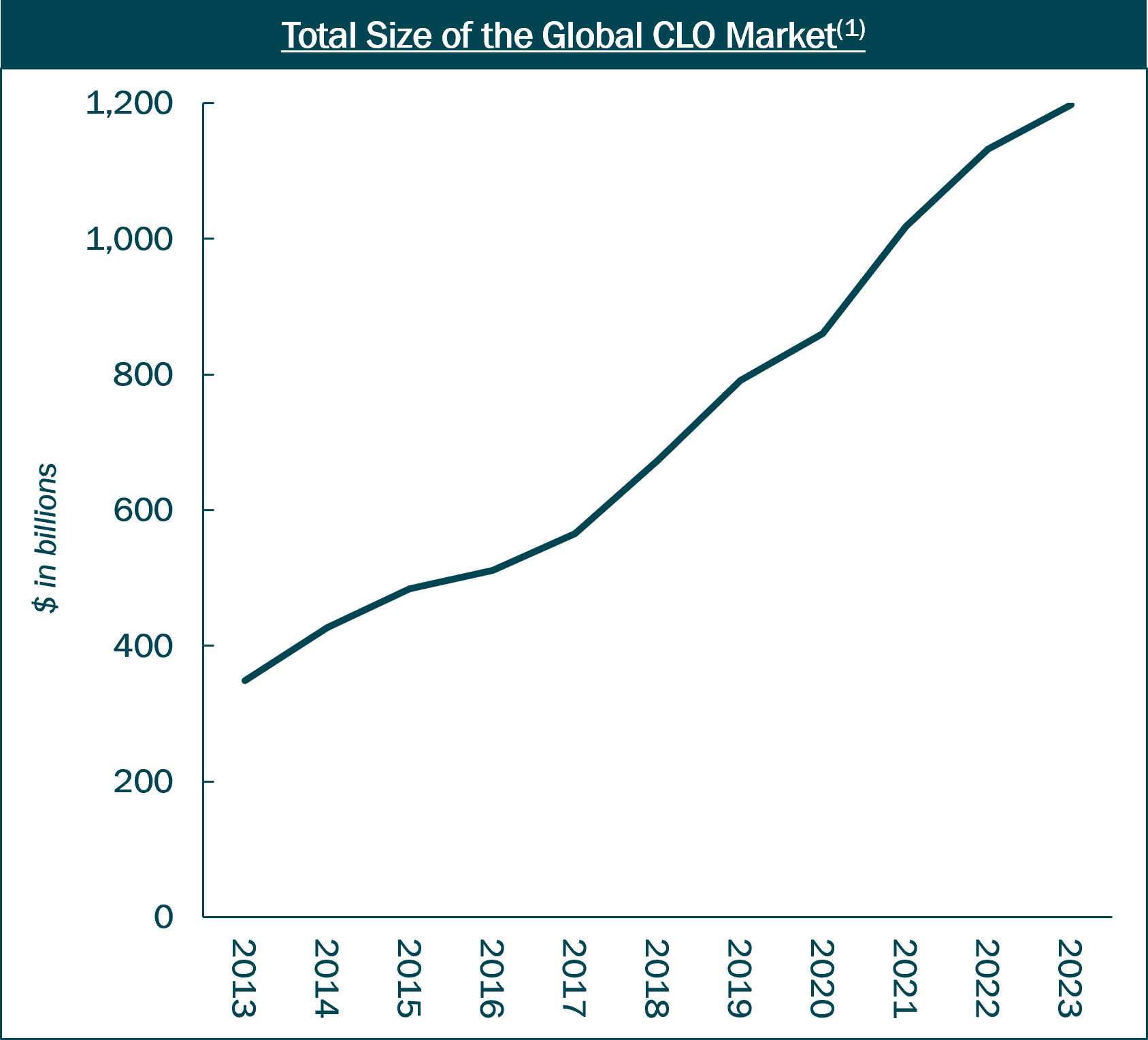

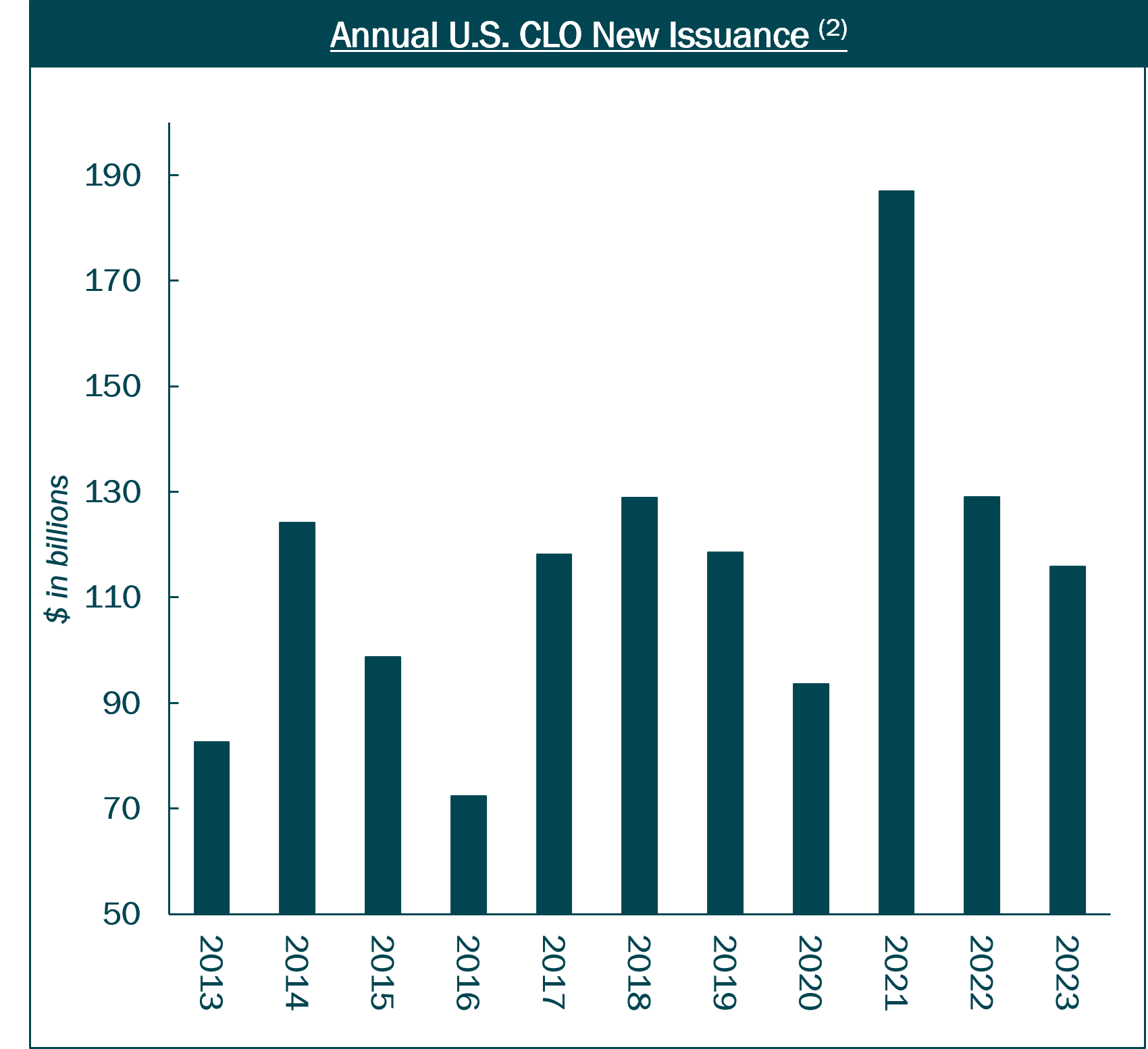

Global CLO market has nearly doubled in size to $1.2 trillion(1) over the past five years and is now the largest asset class in the private-label securitized products universe.

-

This rapid growth has meaningfully improved availability and liquidity of CLO mezzanine debt and equity in the secondary market.

-

CLO market growth has significantly expanded the investment opportunity set, especially as the spectrum of seasoned investment profiles continues to broaden.

Inefficiencies Create Attractive Investment Opportunities

-

Many parts of the CLO market remain highly inefficient, with much of the increased participation in the space coming from investors focused on adding the most liquid and standardized profiles.

-

Attractive investment opportunities exist for sophisticated institutional investors who are able to conduct thorough analysis of the documents, structures, and underlying corporate borrowers in less standardized CLO investment profiles.

-

Dispersion in CLO collateral performance going forward should continue to provide ample ongoing investment opportunities.

-

A CLO-focused closed end fund provides individual investors access to a highly attractive investment strategy otherwise limited to the institutional market.

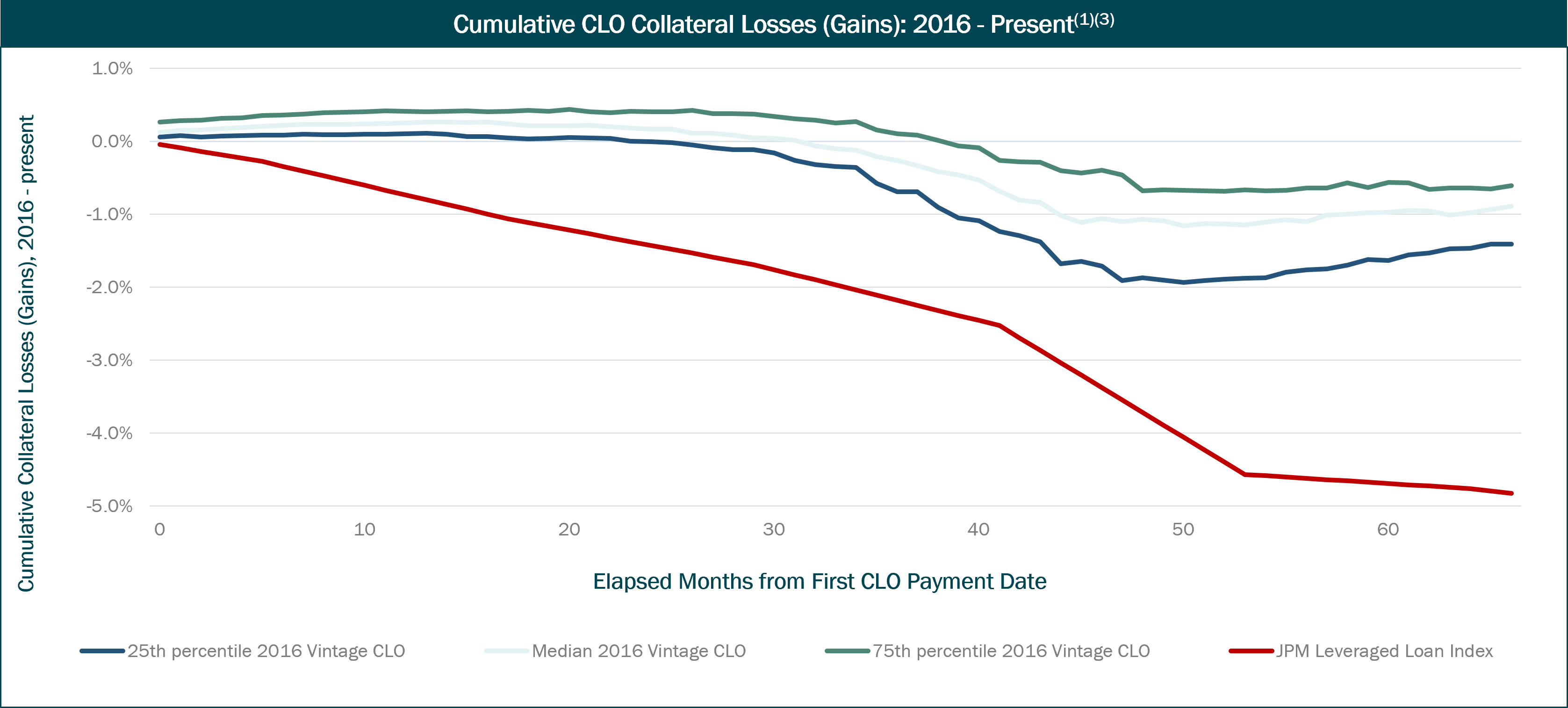

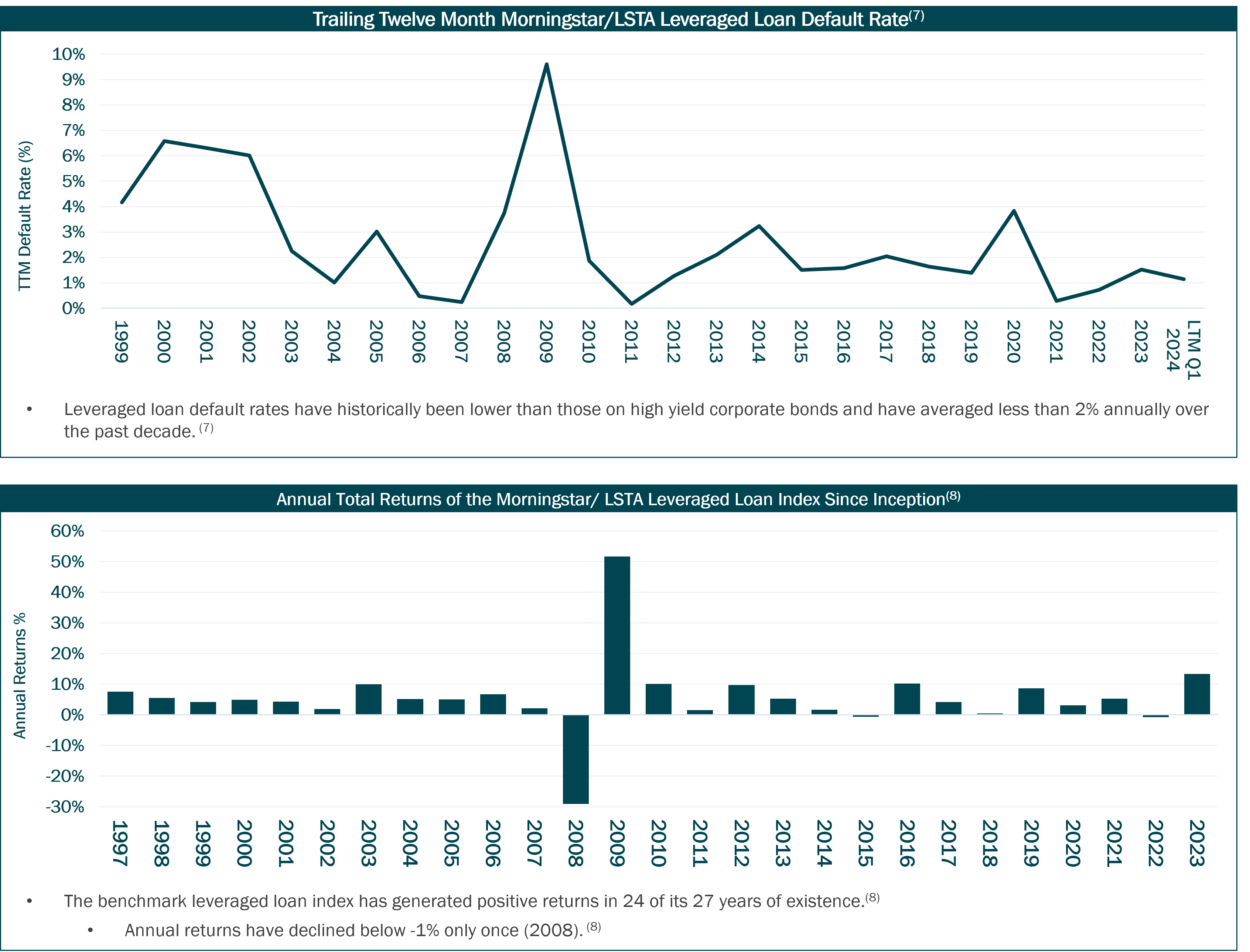

CLOs have historically experienced better credit performance than the benchmark leveraged loan index

-

Historically, CLO debt tranches have demonstrated resiliency to corporate defaults due to structural features that preserve cash flows in times of stress, such as:

- Credit enhancements in the form of subordinate securities and overcollateralization

- Floating rate notes with excess spread

- Deal triggers that divert excess interest to protect debt tranches

-

CLOs are typically actively managed vehicles, allowing collateral managers to rotate the assets in their portfolios to mitigate losses and react to changing market conditions and credit events.

CLO Equity Overview(4)

-

CLO equity tranches can offer an attractive return profile for credit investors, including strong current carry.

-

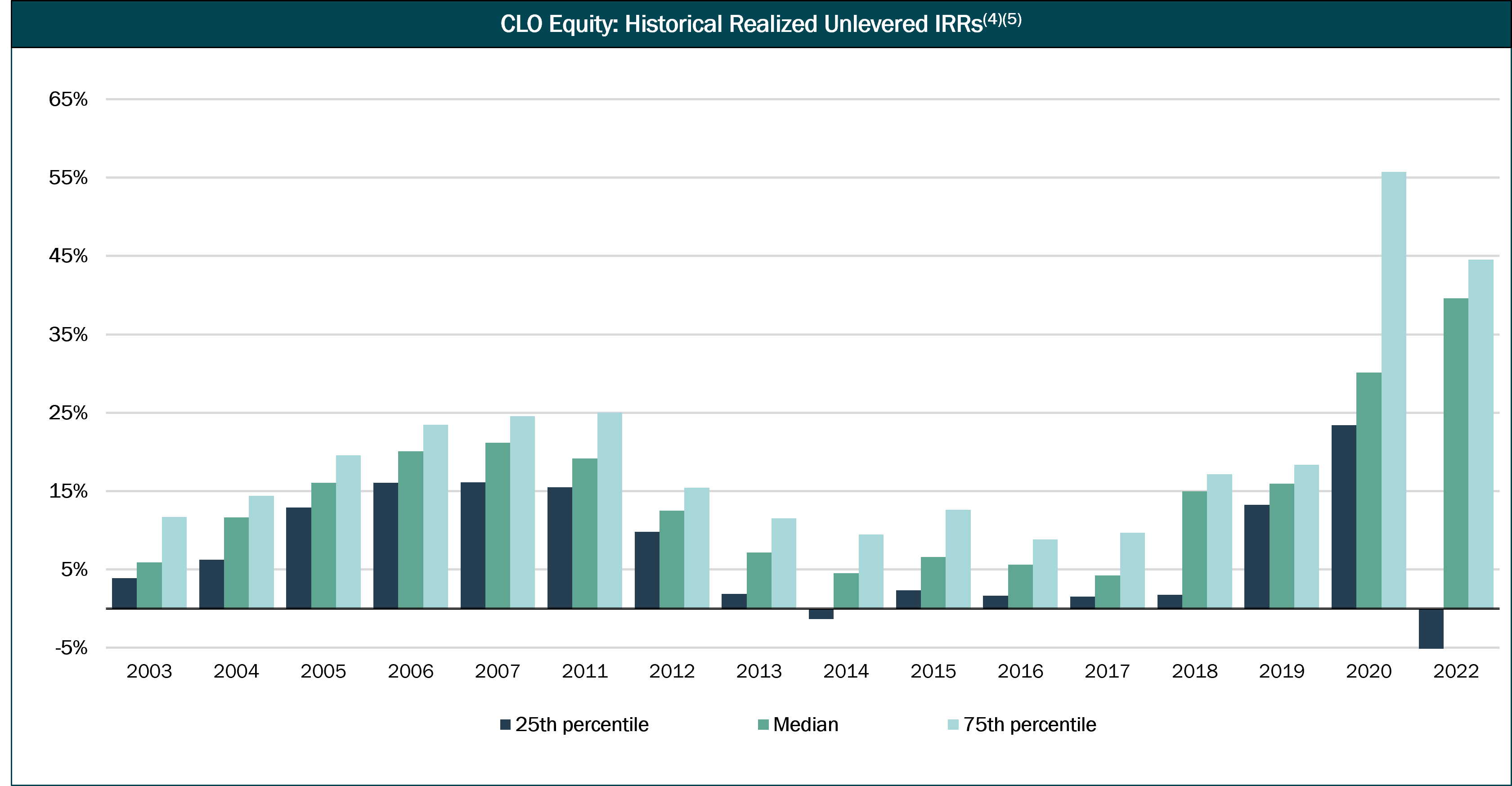

The chart below shows historical realized unlevered internal rates of return ("IRRs") by CLO equity vintage, assuming each equity investment was purchased at new issuance and held to the conclusion of each CLO.

- IRRs may be further enhanced by investing in CLO equity at higher yields in secondary markets and/or by actively trading, both of which are core tenets of Ellington’s strategy.

-

CLO equity vintages between 2003 – 2022 have generated a median unlevered IRR of ~13%, assuming each investment was held from new issuance to deal conclusion.(5)

- However, performance has varied widely between CLOs, and we believe the complexity of the asset class requires strong analytics and underwriting capabilities to determine which investments may under- or out-perform.

CLO Mezzanine Debt Overview

-

CLO mezzanine tranches offer several advantages over other corporate credit sectors including:

- Attractive yield profiles relative to similarly-rated corporate credit investments

- Credit enhancement, allowing structures to withstand significant loss levels

-

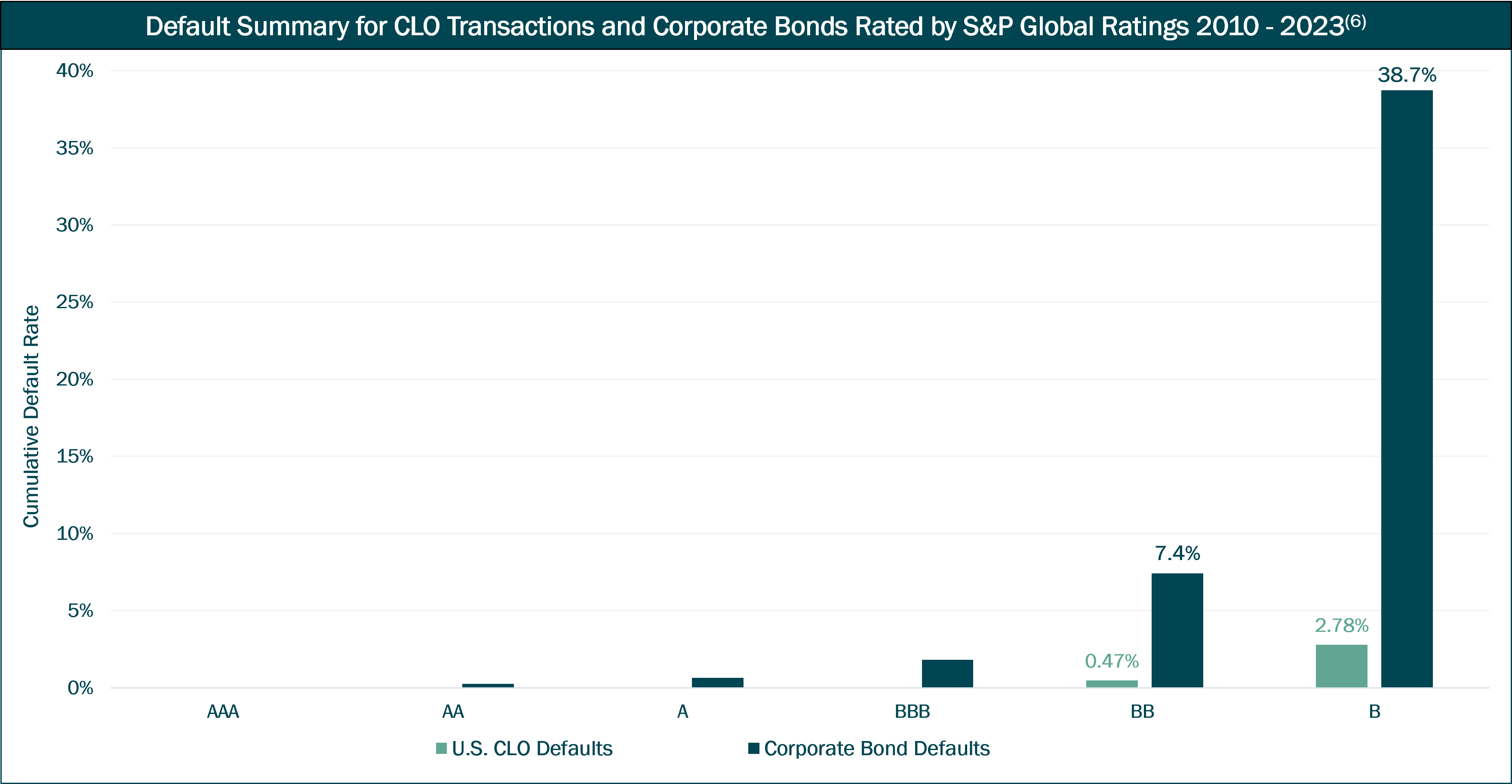

From 2010 through 2023, S&P Global Ratings rated more than 14,000 tranches from over 1,750 CLO transactions and found an average cumulative default rate of only 0.47% for CLO BB tranches and 2.78% for CLO B tranches.

- These long-term cumulative default rates are well below the default rates for similarly rated corporate bonds, as depicted below.

-

Many junior mezzanine debt tranches, which are a core focus of Ellington’s strategy, continue to trade at significant discounts to par even though historical losses have been very low.

Leveraged Loan Performance and Resiliency Over Time

- Source: BofA Global Research.

- Source: Pitchbook | LCD.

- Source: J.P. Morgan.

- Past performance is not necessarily indicative of future results. The table is for illustrative purposes only, the actual performance of EARN’s portfolio may differ from the data presented. The CLO equity performance presented does not reflect expenses and management fees, which will reduce the returns of EARN’s portfolio. There are not enough realized 2021 vintages for performance data.

- Source: BofA Global Research as of December 31, 2023.

- Source: S&P Global Ratings Credit Research & Insights and S&P Global Market Intelligence's CreditPro.

- Source: Morningstar/LCD. Loan default data as of March 31, 2024.

- Source: Morningstar/LCD.